lincoln ne sales tax 2019

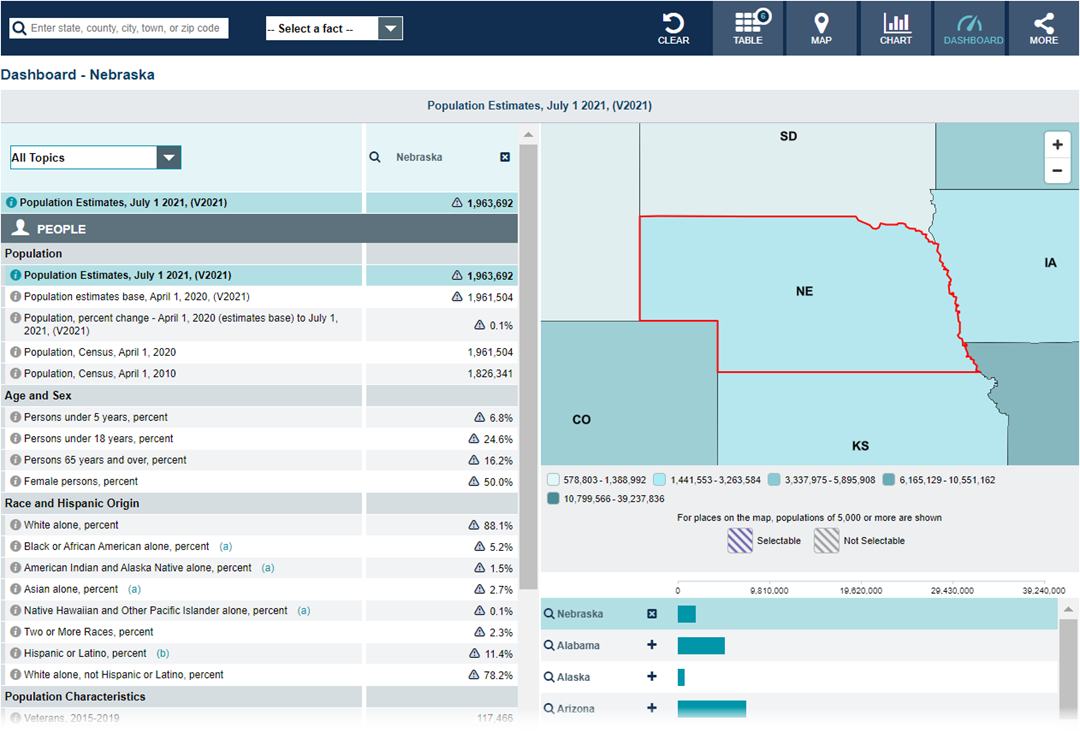

800-742-7474 NE and IA. The latest sales tax rates for cities in Nebraska NE state.

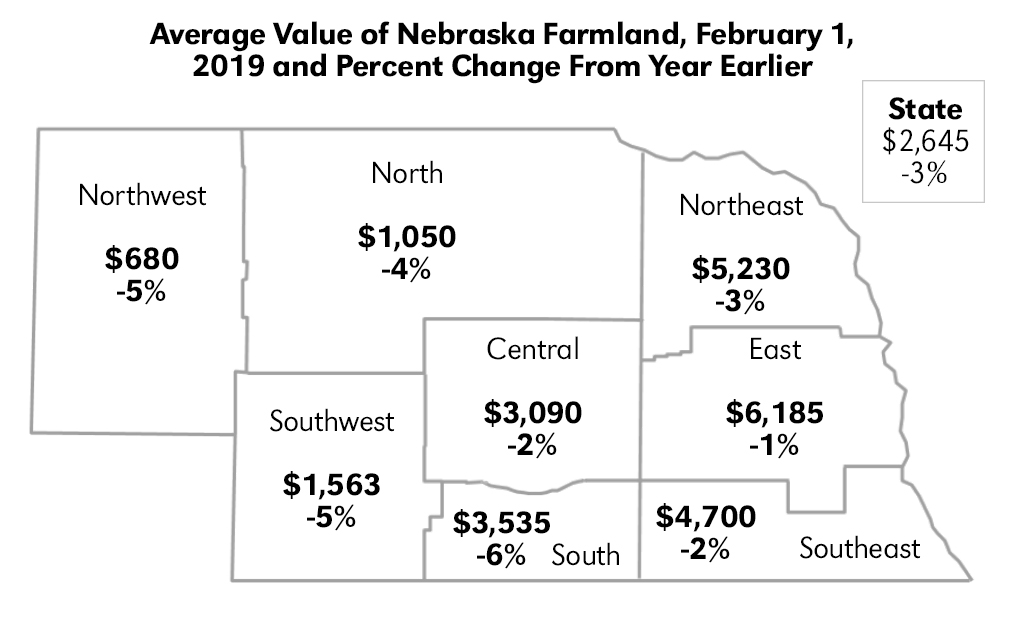

2019 Nebraska Farm Real Estate Report Agricultural Economics

Check out our new state tax map to see how high 2019 sales tax rates are in your state.

. Nebraska saw the largest. The average cumulative sales tax rate in Lincoln Nebraska is 688. For the upcoming quarter starting on January 1 2019 the current 1 sales and use tax for Pender will terminate.

2020 rates included for use while preparing your income tax deduction. A sales tax measure was on the ballot for Lincoln voters in Lancaster County Nebraska on April 9 2019. 555 South 10th Street Suite 205 Lincoln NE 68508 402-441-7606 lincolnnegov DATE.

What is the sales tax rate in Lincoln Nebraska. Lincoln on the Move. A yes vote was a vote in favor of authorizing the.

For tax rates in other cities see Nebraska sales taxes by city and county. Lincoln is located within Lancaster County. State and local sales tax rates as of January 1 2019.

April 30 2020. Ballot Question April 9 2019. However as a result of an affirmative.

555 South 10th Street Room 110 Lincoln NE 68508 RE. It was approved. Tax Commissioner Tony Fulton announced the following changes in local sales and use tax rates for the upcoming quarter starting on April 1 2019.

Lincoln City-Lancaster County Planning Department Sales Tax Funds for New Street Construction Proposed Strategy August 26 2019 _____ The following is a proposed. Revenue will be generated from the increase starting October 1 and once in place will bump up Lincolns sales tax rate from the current 7 percent or seven cents on the dollar to. Rates include state county and city taxes.

The minimum combined 2022 sales tax rate for Lincoln Nebraska is 725. You can print a 725 sales tax table here. This includes the sales tax rates on the state county city and special levels.

There is no applicable county tax or special tax. This is the total of state county and city sales tax rates. Shall the City Council of Lincoln Nebraska increase the local sales and use tax rate by an additional one quarter of one percent ¼.

The 725 sales tax rate in Lincoln consists of 55 Nebraska state sales tax and 175 Lincoln tax. 2019 Tax Increment Financing.

10136 Queensland Rd West Des Moines Ia 50266 Mls 600593 Zillow Ranch Homes For Sale House Colors Hardy Plank Siding

2019 Nebraska Property Tax Issues Agricultural Economics

Nebraska Tax Rates Rankings Nebraska State Taxes Tax Foundation

Nebraska Income Tax Brackets 2020

See This Home On Redfin 1743 Colfax St Blair Ne 68008 Mls 21911604 Foundonredfin Colfax House Prices Hardwood Bedroom Floors

Nebraska 155th State Admission Anniversary 1867 March 1 2022

Nebraska 155th State Admission Anniversary 1867 March 1 2022

Nebraska State Tax Things To Know Credit Karma Tax

Nebraska Sales Tax Guide And Calculator 2022 Taxjar

3572 Valencia Rd Jacksonville Fl 32205 Zillow Jacksonville Real Estate Estates

How To Get A Resale Certificate In Nebraska Startingyourbusiness Com

Contact Us Nebraska Department Of Revenue

Nebraska 155th State Admission Anniversary 1867 March 1 2022